Introduction

The Excise Directorate under the Finance Department, Government of West Bengal plays

the twin role of mobilizing resources for the State and also managing a sector that

has a significant social and public health import. The Directorate is concerned

with the regulation related to the manufacture, supply, distribution and sale of

liquor and other intoxicants in the state, and the collection of state excise duties,

fees and other monies derived from such manufacture, distribution, sale and regulation.

The Directorate achieves these objectives by, -

- a) granting and regulating licenses for the manufacture,

wholesale and retail sale of liquor and spirits used for the manufacture of liquor;

- b) authorizing the manufacture and / or sale of brands

of bottled liquor in the state, through a process of registration of brands of foreign

liquor, colored and flavored spirit, and country spirit, and of the labels under

which they can be manufactured and / or sold;

- c) regulating the movement of liquor, and spirits used

for the manufacture of liquor, into, throughout and from the state, through the

grant and administration of relevant import, export and transport passes;

- d) monitoring and maintaining records of inventories

of liquor, and spirits used for the manufacture of liquor, at all the liquor-manufacturing,

wholesale and retail locations in the state;

- e) operating mechanisms for the collection of state

excise duties on liquor, and fees and other levies charged and imposed by the government

on the manufacture, distribution, and sale of liquor;

- f) carrying out enforcement activities against the

illegal manufacture of liquor, and against the distribution and sale of such illegally

manufactured liquor, and liquor on which the requisite state excise duties and /

or fees have not been paid;

- g) carrying out enforcement activities against the

manufacture, distribution, sale and possession of narcotics; and

- h) regulating the manufacture, supply, distribution

and sale of spirits and narcotic drugs for medicinal and industrial purposes, through

the issue and administration of relevant licenses, permits and passes.

In short, the main objective of the Excise Department is to manage the supply-chain

of liquor and other intoxicants in the state, with a view to ensure that all liquor

and other intoxicants manufactured or otherwise available in the state, are sourced

through legal channels, and to prevent the loss of revenue due to the government

on account of excise duties and fees.

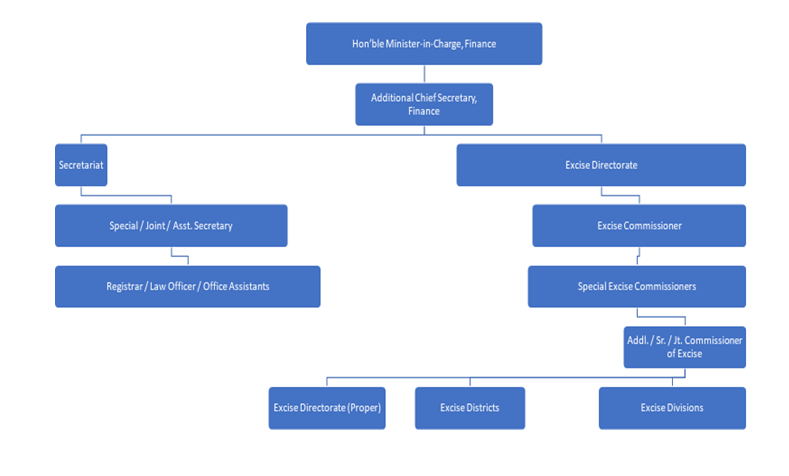

Organizational Structure

There are broadly three wings under the Excise Directorate, namely, Revenue, Human

Resource and Enforcement, each under a Special Excise Commissioner who assist the

Excise Commissioner in the Excise administration of the State. There are Additional

/ Senior / Joint Commissioners of Excise under each wing as follows: -

|

Sl.

No.

|

Special Commissioner Post(s)

|

Additional/SrJoint/Joint

Commissioner Post(s) under Special Commissioner

|

Ordinary Jurisdiction /

work allotment

|

|

(1)

|

(2)

|

(3)

|

(4)

|

|

1.

|

Special

Excise Commissioner (Revenue)

|

Additional/Sr Joint/Joint Commissioner (Revenue – I)

|

Distilleries & Warehouses Section

Matters relating to Industrial and Medicinal Alcohol (at Excise Directorate level)

|

|

Additional/SrJoint/Joint Commissioner (Revenue – II)

|

Foreign Liquor Section

|

|

Additional/SrJoint/Joint Commissioner (Revenue – III)

|

Retail Establishments; Statistics & Analysis Cell

|

|

2.

|

Special

Excise Commissioner (Enforcement)

|

Additional/SrJoint/Joint Commissioner (Enforcement – I)

|

The following Excise Divisions including Excise Districts / Zones under the division:

Jalpaiguri Excise Division; Malda Excise Division; Krishnanagar Excise Division;

Kharagpur Excise Division &

Narcotics Cell, Excise Directorate

|

|

Sl.

No.

|

Special Commissioner Post(s)

|

Additional/SrJoint/Joint

Commissioner Post(s) under Special Commissioner

|

Ordinary Jurisdiction /

work allotment

|

|

(1)

|

(2)

|

(3)

|

(4)

|

|

|

|

Additional/SrJoint/Joint Commissioner (Enforcement – II)

|

The following Excise Divisions including Excise Districts / Zones under the division:

Alipore Excise Division; Barrackpore Excise Division;

Bardhaman Excise Division; Durgapur Excise Division.

|

|

3.

|

Special

Excise Commissioner (HR)

|

Additional/SrJoint/Joint Commissioner (Head Quarters)

|

Organization Section Establishment Section

|

|

Additional/SrJoint/Joint Commissioner (Training)

|

Training Section

|

|

Additional/SrJoint/Joint Commissioner (Law)

|

Law Section

|

There are Superintendents of Excise under the different sections of the Excise Directorate

as follows: -

|

Sl.

No.

|

Additional / Sr

Joint/Joint Commissioner Post(s)

|

Superintendent of Excise Post(s) under Additional / Sr Joint/Joint Commissioner

|

Ordinary Jurisdiction / work allotment

|

|

(1)

|

(2)

|

(3)

|

(4)

|

|

1.

|

Additional/SrJoint/Joint Commissioner (Revenue – I)

|

Superintendent of Excise (Revenue- I)

|

Distilleries

& Warehouses Section; Special Section

(at

Excise Directorate level)

|

|

2.

|

Additional/SrJoint/Joint Commissioner (Revenue – II)

|

Superintendent of Excise (Revenue- II)

|

Foreign Liquor Section

|

|

3.

|

Additional/SrJoint/Joint Commissioner (Revenue – III)

|

Superintendent of Excise (Revenue- III)

|

Retail Establishments; Statistics & Analysis Cell

|

|

4.

|

Additional/SrJoint/Joint Commissioner (Enforcement – I)

|

Superintendent of

Excise (Enforcement – I)

|

The following Excise Divisions

including Excise Districts / Zones under the division: Jalpaiguri

Excise Division;

Malda Excise Division; Krishnanagar

Excise Division;

Kharagpur

Excise Division

&

Narcotics Cell, Excise Directorate

|

|

5.

|

Additional/SrJoint/Joint Commissioner (Enforcement – II)

|

Superintendent of

Excise (Enforcement – II)

|

The following Excise Divisions including Excise Districts / Zones under the division:

Alipore Excise Division; Barrackpore Excise Division;

Bardhaman Excise Division;

|

|

Sl.

No.

|

Additional / Sr

Joint/Joint Commissioner Post(s)

|

Superintendent of Excise Post(s)

under Additional / Sr Joint/Joint Commissioner

|

Ordinary Jurisdiction / work allotment

|

|

(1)

|

(2)

|

(3)

|

(4)

|

|

|

|

|

Durgapur

Excise Division.

|

|

6.

|

Additional/SrJoint/Joint Commissioner (Head Quarter)

|

Superintendent of Excise (HR-I) shall be designated as Superintendent of Excise

(HQ)

|

Organization Section Establishment Section

|

|

7.

|

Additional/SrJoint/Joint Commissioner (Training)

|

Superintendent of Excise (HR-II)

|

Training Section

|

|

8.

|

Additional/SrJoint/Joint Commissioner (Law)

|

Superintendent of Excise (HR-III)

|

Law Section

|

|

9.

|

Additional/SrJoint/Joint Commissioner (Systems)

|

Superintendent of Excise (Systems)

|

Systems / I.T Cell

|

|

10.

|

Additional Commissioner (Central Investigation Section)

|

Superintendent of Excise (Central Investigation Section) - I

|

Central Investigation Section

|

|

11.

|

Superintendent of Excise (Central Investigation Section) - II

|

FUNCTIONS OF DIFFERENT SECTIONS OF THE EXCISE DIRECTORATE

1. Establishment Section :-

This section looks after the service matter of the employees of all ranks in the

Excise Directorate including the officers belonging to the West Bengal Excise Service.

In addition, this section is also entrusted with the processing of all applications

regarding grant of all kinds of retail Excise Licenses.

2. Distilleries & Warehouses Section :-

This Section looks after manufacture and supply of Country Spirit in the State.

The Section also monitors manufacture and supply of rectified spirit by the distilleries

of the State, regulates imports of Rectified Spirit for potable purpose and administers

the provisions of the W.B. Molasses Control (Regulation, Storage & Transport) Notified

Order, 1986 in the State. Compilation of different reports and returns in connection

with consumption of intoxicants and collection of revenue is entrusted to this Section.

The purchase of Excise Opium for medical purpose and its distribution to all Opium

Depots over the State through districts treasuries is done by this Section. Regular

meetings, conferences, seminars, etc. at the Excise Directorate are also arranged

by this Section.

3. Law Section :-

This Section is responsible for proper representation before different legal forums

in cases where the Department is a party and to take steps to defend and protect

the interest of the Department in such cases.

4. Foreign Liquor Section :-

The Section looks after the manufacturing and supply of Foreign Liquor in the State.

This Section regulates import of ENA and other kinds of Spirit required in the manufacturing

of potable Foreign Liquor. The Section controls export of India made Foreign Liquor

and supply of the same out of India.

5. Organization Section :-

The Section looks after among other matters construction, repair, maintenance of

Buildings, Barracks, Warehouses, Lands of the Excise Department including their

up- keeping etc. The Section also oversees the supply of office furniture, apparatus,

instruments, uniforms, stationeries and vehicles – both Government and hired. Budget

and allotment of fund to the outlying districts and organisations under the control

of Excise Directorate, which is essential for running the day to day administration

is done from this Section.

6. Excise Divisions :-

Under the general control of the Excise Commissioner, West Bengal, there are now

eight Excise Divisions – two in Jalpaiguri administrative division, three in Burdwan

administrative division and three in Presidency administrative division. Each such

Division is headed by a Deputy Commissioner of Excise. There shall be a striking

force under the control of the Deputy Commissioner of Excise in each Division. This

striking force comprises of Superintendent of Excise, Additional Superintendent

of Excise, and Deputy Excise Collector(s), Sub-Inspector of Excise, Assistant Sub-inspector

of Excise and Excise Constables.

7. Narcotic Cell :-

This Cell is entrusted for prevention and detection of crimes relating to Narcotic

Drugs and Psychotropic Substances Act, 1985 and prosecution of offenders under the

Act.

8. Special Section :-

Administration relating to Industrial Alcohol and import of Rectified Spirit for

medicinal purposes are also entrusted to this Section.

9. Training Institute :-

This institute imparts both theoretical and practical training to the new entrant

Excise officials of different cadres as well as organizes in-service training programmes

for the officers at different training institutes viz. Police Training College,

Administrative Training Institute, National Academy of Central Excise and Narcotics

etc.

10. Computer Cell :-

There is a Computer Cell in the Excise Directorate under the general control of

Excise Commissioner and is headed by an officer of the rank of Additional / Sr.

/ Joint Excise Commissioner who is assisted by two Deputy Excise Collectors. This

cell is entrusted to look after the e-governance programme in the Excise Directorate.

11. Statistics and Analysis Cell :-

The Statistics and analysis cell is headed by one Additional / Sr. / Joint Commissioner

of Excise (Statistics and Analysis) at the Excise Directorate under the general

control of the Excise Commissioner, West Bengal. This cell shall be manned by such

officers and personnel as may be arranged by the Excise Commissioner from within

the sanctioned strength of Excise personnel.

12. Central Investigation Section:

The primary object of the Central Investigation Section is to offer an effective

resistance to organized smuggling by means of combined action on the part of the

officers of different districts and of divisions. The duties of the officers posted

here are: --

- (i) To receive from, collate and distribute to all districts the information regarding

smugglers and offences against the Excise and Narcotic Laws.

- (ii) To advise in local investigation when necessary.

- (iii) To receive information from, to collate it and to distribute it to other states

/ country, between which and West Bengal inter-state smuggling is known or suspected

to exist, and to arrange for the co-operation of the Excise officers of our state

and elsewhere in making enquiries and dealing with offenders.

13. Chemical Examination Laboratory :-

The Laboratory is headed by the Chemical Examiner to the Government of West Bengal.

He is assisted by two the Deputy Chemical Examiners. The Laboratory is entrusted

with the analysis of samples of seized intoxicants sent by different Investigating

Officers detected under the B.E. Act and the N.D.P.S. Act. The reports of such analysis

play an important role in prosecution. Besides this work the Laboratory also tests

samples of different intoxicants received from manufacturing units and warehouses.

Special Section also sends samples to this Laboratory for analysis and test to oversee

as to whether the manufactured products conform to the prescribed standard and norms.

14. Internal Audit Unit :-

Internal Audit Wing at Excise Directorate is an independent organization under Excise

Commissioner. This Wing is headed by one Deputy Commissioner (Audit & Accounts)

who is assisted by three Assistant Commissioner (Accounts) & three Auditors.

The main function of this Wing is to ensure that the existing regulations and procedures

are being carried out in proper manner in respect of Govt. Receipts & Expenditure.

The Unit is responsible for scrutinizing and detecting irregularities in assessment

and levy of State Excise Duty and different Fees payable by the holders of Licenses

in accordance with the provisions of the Bengal Excise Act, 1909 and N.D.P.S Act,

1985 and the rules framed thereunder.

This Unit also helps in replying the queries raised by Hon’ble Public Accounts Committee,

C.A.G. of India, Principal A.G. (Audit), West Bengal & A.G. (E.R.S.A.), West

Bengal.

Staff Pattern and Strength:

|

Designation

|

Sanctioned Strength

|

Current Strength

|

|

West Bengal Revenue Service

|

312

|

286

|

|

Inspector of Excise

|

117

|

0

|

|

Sub-Inspector of Excise

|

770

|

265

|

|

Assistant Sub Inspector of Excise

|

1165

|

154

|

|

Excise Constable

|

4652

|

1546

|

|

Administrative Officer

|

2

|

2

|

|

Cash and Account Officer

|

2

|

1

|

|

Office Superintendent

|

2

|

2

|

|

Special Assistant

|

1

|

1

|

|

Head Assistant

|

3

|

5

|

|

Personal Assistant(Stenographers)

|

11

|

5

|

|

U D Assistant

|

31

|

14

|

|

Supervisory Typist

|

2

|

2

|

|

Record Muharrir Gr I

|

1

|

0

|

|

Record Muharrir Gr II

|

1

|

1

|

|

Auditor

|

3

|

0

|

|

Cash Sarkar

|

1

|

0

|

|

Grade I Typist

|

6

|

5

|

|

Basic Grade Typist

|

8

|

0

|

|

Bengali Translator

|

1

|

0

|

|

Duplicating Operator

|

1

|

0

|

|

Record Supplier

|

1

|

1

|

|

Excise Motor Driver

|

93

|

30

|

|

Group “D”(Including Duftry Office Peon, Farash, Darwan, Sweeper)

|

19

|

6

|

|

Total

|

7205

|

2326

|

Acts Administered:

Following Acts and rules framed thereunder are administered by the Excise Directorate,

West Bengal: -

- 1. The Bengal Excise Act, 1909 (Ben. Act V of 1909),

- 2. The Narcotic Drug and Psychotropic Substances Act, 1985 (Central Act 61 of 1985),

- 3. The West Bengal Molasses Control Act, 1973 (W.B. Act VI of 1973).

Acts Administered:

|

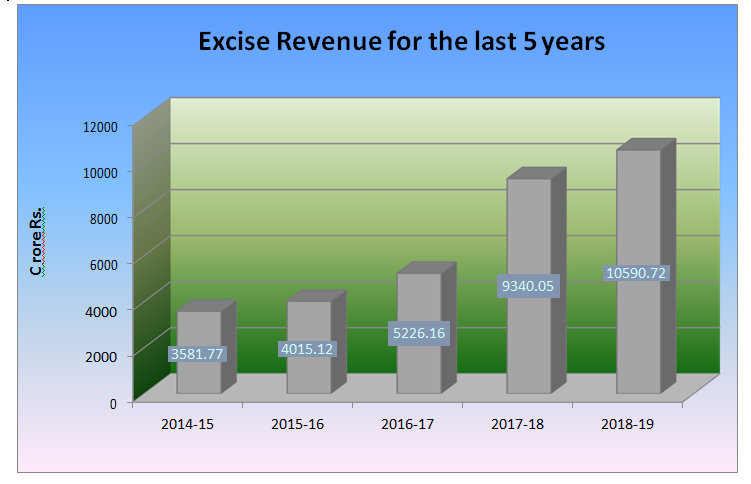

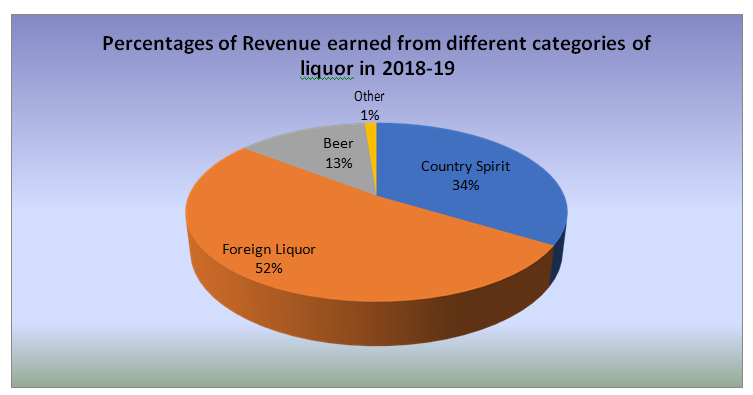

Excise Revenue collection for the last 5 years with growth rate

|

|

|

|

|

|

Year

|

Revenue (Cr.)

|

Growth rate (%)

|

|

2014-15

|

3581.77

|

19.37

|

|

2015-16

|

4015.12

|

12.10

|

|

2016-17

|

5226.16

|

30.16

|

|

2017-18

|

9340.05

|

78.72

|

|

2018-19

|

10590.72

|

13.39

|

eGovernance Initiatives under the

Excise Directorate:

The West Bengal Excise Directorate plays the twin role of mobilizing resources

for the State, and managing a sector which has a significant social and

public-health import. Till a couple of year back the Excise Directorate, under

the West Bengal Finance Department, had been operating on legacy manual-based

systems, using antiquated procedures that had not been changed for decades. The

department displayed the typical symptoms of an inefficient, over- bureaucratic

organization:

Keeping the revenue-potential of the directorate and the sensitivity of the

liquor-sector in mind, the Government embarked on a major process-reengineering

initiative for the Excise Directorate during 2014-15.

The reengineering initiative involved the implementation of Information

Technology solutions for departmental processes. This was done through the

“eAbgari” project developed and implemented with the technical assistance of

National Informatics Centre, and it has been the single-most transformational

factor in the way the Excise Directorate functions.

The Directorate’s services are now delivered online. This has eliminated entire

administrative layers involved in the processing of service requests. Earlier,

service requests had to be made through paper applications, which had to travel

from table to table, and involved an enormous amount of paperwork. After the

implementation of eAbgari, liquor manufacturers, wholesalers and retailers make

most service requests – applications for Import Permits, License Renewals,

Registration of Brands etc – online. The eAbgari software validates the requests

for compliance with existing rules and procedures. Fewer officials are involved

in the processing of the requests. This has drastically reduced application

processing times as well as chances of error.

The key components of the eAbgari project includes web-based mechanisms for the

grant and renewal of state excise licenses, issue of permits and passes for the

import, export and transport of liquor, registration of brands of liquor

manufactured or sold in the state, automated inventory management of liquor at

manufactories, wholesalers and retailers, e-payment of excise duties and fees,

GPS-based mapping of liquor businesses in the state and grievance-handling

systems. Seamlessly integrating a wide array of modern ICT technologies - the

web, bar-codes and QR codes, SMS, BI Tools, GIS - eAbgari has significantly

reduced service-delivery times for the West Bengal Excise Directorate and has

greatly enhanced the department’s regulatory capabilities.

Specifically, state excise process standardization & simplification are done

through technology enabled business process re-engineering in eAbgari to render

the following e- Services:-

G2C Services

- Robust Grievance lodging mechanism

- Delivery of life saving drugs to CCUs within 90 % reduced time and ease of

availability

- Web based universal access to the services offered by the directorate

- Enhancement of enforcement activities through use of GI tools, use of

anti-evasion tools like GPS based tracking of spirit movement and real time

monitoring of preventive operations of the directorate

- Hassle free and easy availability of laboratory spirits for educational

institutions

- Availability of information related to administrative process flows for services

rendered

- Pendency checker and service request status information through the web and SMS

services

G2B Services

- Grant and renewal of State Excise licenses

- Issuance of Permits/Passes for Import/Transport/Export of Bulk Spirit & Packaged

Liquor

- Registration of labels for Packaged Liquor

- Enabling hassle free collection mechanism for Excise duties and fees thru’

ePayment Gateway

- Automated inventory management at business premises

G2G Services

- 360-degree profile of licensees of the directorate, brands registered in the

State, and various permits and passes requisitioned and executed

- Use of Business Intelligence tools in data aggregation for administrative

intervention and policy formulation

- Plugging of revenue loopholes

- Streamlining and systematizing Inter-departmental and Intra-Departmental

information resulting in increased efficiency in Administration, cutting down

response times and delivering better services

- Dynamic dashboards for officers for monitoring of pendency and traceability of

decisions across the hierarchical set up for fixing up responsibility and

accountability

- Reconciliation of every drop of spirit imported or manufactured.

G2E Services

- Digital archiving of documents & information

- Easy & error free record maintenance and data retrieval

- Easy access to rules regarding their domain of work through State Excise Portal

& Knowledge Intranet

- Anti-evasion tools built into the system for checking frauds and malpractices

and authenticating payment information of Excise taxes by assesses

eGovernance Awards & Recognition:

The eAbgari project was awarded the National Award for eGovernance 2017-18

(Silver) for “Excellence in Government Process Re-engineering” by the Department

of Administrative Reforms and Public Grievance, Government of India. Earlier the

eAbgari project received the Award of Appreciation from the CSI Nihilent

Foundation ranking among the top 20 projects in the country in November 2015 and

also was awarded the 2014 Skoch Platinum Award of Excellence as one of the best

projects in the country.

Major Achievements of the Excise Directorate during

the F.Y 2018-19:

A. Strengthening of the regulatory framework in the

potable liquor manufactories -

- (i) Finalized introduction of automated system for measurement of spirit and

related control in the manufactories of all kinds of potable liquor to minimize

human intervention and to bring transparency in control mechanism in such

manufactories. This reduces the incidents of wastage of spirit drastically

during processing of strong spirit to alcoholic beverages. The reports generated

from such arrangements have also lessened the requirements of maintenance of

handwritten registers. This has resulted in seamless reconciliation and

achieving of data for policy making.

- (ii) Introduction of a new system of spirit accounting and measurement by

switching from the existing proof litre-based measurement system to % V/v and AL

based measurement system including drafting of necessary rules and finalizing

the standard operation procedures. This makes the system at per with

International standard of measurement of alcohol for taxation purpose.

- (iii) In compliance to the mandate of maintenance food safety in alcoholic

beverages use of food grade lubricants and de mineralized water make mandatory

in the manufacturing process of potable liquor.

B. Structural re-organization and mobility support –

- (i) In order to ensure enhanced efficiency in enforcement activities and to make

the Excise Administration co-terminus with the Police Administration for better

co- ordination Hooghly District was trifurcated into three Excise Districts of

Chandannagar, Singur and Arambagh and Murshidabad District was bifurcated into

two Excise Districts of Berhampore and Jangipur;

- (ii) Two posts of Special Excise Commissioners at the Excise Directorate have

been created. In order to specify the role of the Special Excise Commissioners,

the work load in the Excise Directorate was demarcated under three sections,

namely, Revenue, Human Resources and Enforcement and put under the overall

supervision of a Special Excise Commissioner under the Excise Commissioner;

- (iii) In order to ensure round the clock preventive activities in the vulnerable

areas of Excise crime of 117 Excise Circles have been upgraded to the level of

Excise Stations and placed under Inspector of Excise

- (iv) The sole Chemical Examination Laboratory located in Kolkata being tasked

with examination of all criminal case samples pertaining to Excise and Police

Cases related to liquor and intoxicants, coupled with NDPS samples and

industrial samples in many cases, has often left the laboratory overburdened,

which in turn has adversely affected prosecution of Excise cases in Courts due

to its inability to deliver test reports in time two Regional Chemical

Examination Laboratories have been created at Asansol in Paschim Bardhaman and

Siliguri in Darjeeling.

C. Policy level interventions for optimization of

excise revenue -

- (i) Duty on 50 degree Under Proof packaged Foreign Liquor has been rationalised.

- (ii) To optimize the production capacity existing country spirit bottling plants

such manufactories are allowed to manufacture of 50 degree UP Foreign Liquor at

Country Spirit Bottling Plants.

- (iii) Rationalization of opening and closing hours of different categories of

retail licenses.

D. E-Governance initiatives –

- (i) Deployment of the revamped eLicensing Module with end to end process flow

for electronic handling of retail license applications from submission till

grant of demat digitally signed license to applicants.

- (ii) Various new modules launched like Export Pass for Country Spirit Module,

Supply of Customs Duty-Free BIO products to Star Category hotels through the

WBSBCL Module, Production and eReturn module for Breweries, QR Coded Hologram

Tagging module for breweries, Warehouse Daily Monitoring System and Breakage

Analysis Tools, Destruction of Expired and Unfit packaged liquor Module etc.

- (iii) Deployment of an integrated system with all Police Commissionerates for

single window clearance of Excise Permits and Licenses in Police Commissionerate

areas.

- (iv) Deployment a system for automated renewal of retail licenses in a seamless

fashion.

- (v) Redesigning and upgrading the eAbgari Spirit Accounting and Inventory

Management System following administrative decision to switch from the existing

Degree Proof and LPL based measurement system to % V/v and AL based measurement

system.

RESULT

Collection of Excise Revenue has gone up from Rs. 9340 Crores during 2017-18 to

Rs 10590 crs in the year 2018-19 registering a growth of 13.39 %.

Contact Details of Key Officials:

|

Sl. No

.

|

Name

|

Designation

|

Phone No.

|

Fax No.

|

e-Mail Address

|

|

1.

|

Dr. S Uma Sankar, IAS

|

Excise

Commissioner, West Bengal

|

033-

22259779

|

033-

22216205

|

ec.wb- excise@nic.in

|

|

2.

|

Sri Gautam Ghosh, WBRS

|

Special Excise Commissioner, HR & Revenue

|

033-

22374032

|

033-

22216205

|

igkg65@gmail.com

|

|

3.

|

Sri Subrata Biswas, WBRS

|

Special Excise Commissioner, Enforcement

|

033-

22379143

|

033-

22216205

|

specialcommissione renforcement@gmail.com

|